All about Transaction Advisory Services

Table of ContentsHow Transaction Advisory Services can Save You Time, Stress, and Money.Excitement About Transaction Advisory Services8 Simple Techniques For Transaction Advisory ServicesIndicators on Transaction Advisory Services You Need To KnowSome Known Incorrect Statements About Transaction Advisory Services

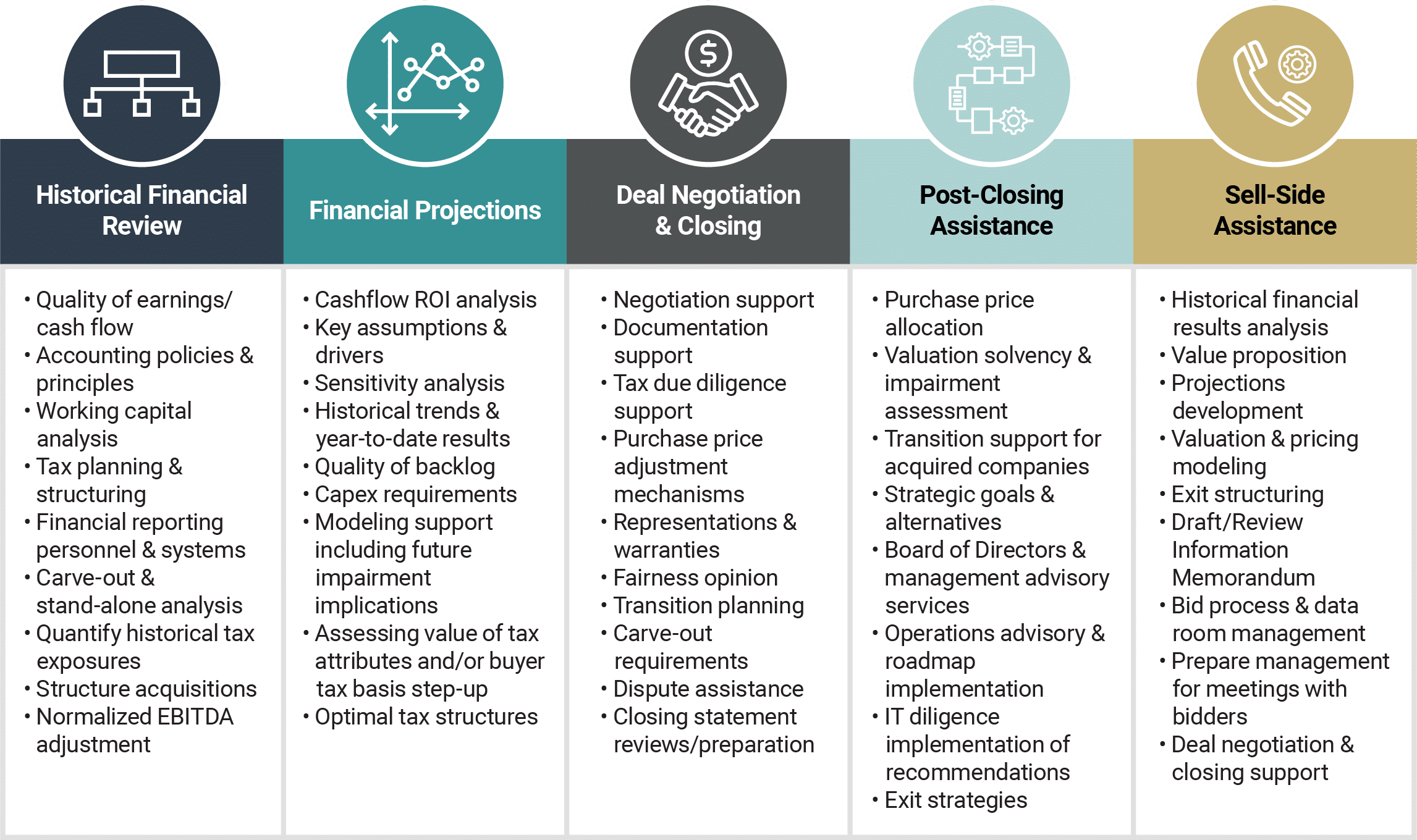

This step ensures the organization looks its finest to prospective buyers. Obtaining business's worth right is crucial for a successful sale. Advisors utilize different techniques, like affordable capital (DCF) analysis, comparing to comparable firms, and current purchases, to find out the fair market price. This aids establish a fair rate and negotiate efficiently with future buyers.Transaction advisors action in to aid by obtaining all the needed information organized, answering inquiries from customers, and arranging visits to the business's location. Purchase advisors use their proficiency to assist service proprietors take care of tough settlements, meet buyer expectations, and structure bargains that match the proprietor's goals.

Satisfying legal rules is important in any type of service sale. Purchase consultatory services collaborate with legal specialists to produce and review agreements, arrangements, and other lawful papers. This reduces dangers and sees to it the sale adheres to the legislation. The role of purchase advisors expands beyond the sale. They aid local business owner in preparing for their next actions, whether it's retirement, beginning a new endeavor, or handling their newfound wealth.

Deal experts bring a riches of experience and knowledge, guaranteeing that every facet of the sale is taken care of expertly. With tactical prep work, assessment, and negotiation, TAS assists local business owner achieve the greatest feasible list price. By making sure lawful and regulatory compliance and managing due diligence along with various other offer employee, transaction advisors lessen potential threats and obligations.

4 Easy Facts About Transaction Advisory Services Explained

By comparison, Large 4 TS groups: Service (e.g., when a potential buyer is conducting due persistance, or when a deal is shutting and the buyer needs to integrate the company and re-value the seller's Annual report). Are with charges that are not linked to the deal shutting successfully. Gain costs per interaction someplace in the, which is much less than what investment banks gain also on "little offers" (however the collection probability is also much greater).

The meeting inquiries are really comparable to investment banking interview questions, yet they'll focus much more on bookkeeping and appraisal and less on subjects like LBO modeling. Expect questions about what the Adjustment in Working Funding methods, EBIT vs. EBITDA vs. Web Revenue, and "accounting professional only" topics like trial equilibriums and just how to walk via occasions utilizing debits and credit scores instead of monetary statement adjustments.

The Main Principles Of Transaction Advisory Services

that demonstrate exactly how both metrics have actually changed based upon items, networks, and customers. to judge the precision of monitoring's past forecasts., including aging, supply by item, average levels, and arrangements. to establish whether they're completely fictional or somewhat credible. Specialists in the TS/ FDD teams may also speak with monitoring concerning everything above, and they'll compose a detailed report with their findings at the end of the procedure.

, and the basic form looks like this: The entry-level function, where you do a great deal of data and economic analysis (2 years for a promo from here). The following level up; comparable job, Continue yet you obtain the even more fascinating bits (3 years for a promo).

In particular, it's difficult to obtain advertised beyond the Manager degree due to the fact that few people leave the work at that phase, and you need to start showing proof of your capability to produce revenue to advancement. Let's begin with the hours and way of living since those are less complicated to explain:. There are periodic late nights and weekend job, however absolutely nothing like the frantic nature of investment banking.

There are cost-of-living adjustments, so anticipate reduced compensation if you're in a less costly location outside major economic (Transaction Advisory Services). For all positions other than Companion, the base salary consists of the bulk of the overall settlement; the year-end reward could be a max of 30% of your base salary. Commonly, the most effective method to increase your profits is to change to a different company and bargain for a greater income and reward

Some Known Details About Transaction Advisory Services

At this phase, you need to simply stay and make a run for a Partner-level role. If you want to leave, possibly relocate to a customer and do their assessments and due diligence in-house.

The primary problem is that since: You normally need to join another Big 4 team, such as audit, and job there for a couple of years and after that relocate into TS, work there for a couple of years and after that move into IB. And there's still no guarantee of winning this IB role due to the fact that it relies on your area, customers, and the working with market at the time.

Longer-term, there is additionally some threat of and due to the fact that reviewing a company's historical financial info is not view it exactly rocket science. Yes, humans will always need to be included, however with even more advanced innovation, lower headcounts might possibly support customer engagements. That claimed, the Purchase Providers group defeats audit in terms of pay, work, and leave chances.

If you liked this article, you may be thinking about analysis.

Unknown Facts About Transaction Advisory Services

Develop sophisticated economic structures that aid in establishing the actual market worth of a company. Offer advising operate in relationship to business assessment to assist in negotiating and prices frameworks. Discuss one of the most appropriate kind of the deal and the sort of consideration to employ (cash money, stock, earn out, and others).

Develop action strategies for risk and exposure that have been identified. Do assimilation planning to determine the process, system, and organizational adjustments that might be required after the bargain. Make mathematical estimates of assimilation costs and advantages to analyze the financial rationale of combination. Establish standards for integrating divisions, technologies, and company processes.

Evaluate the potential consumer base, market verticals, and sales cycle. The operational due diligence uses vital understandings right into the functioning of the company to be obtained worrying risk evaluation and worth production.